Call For Spectrum Overlay Plan

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

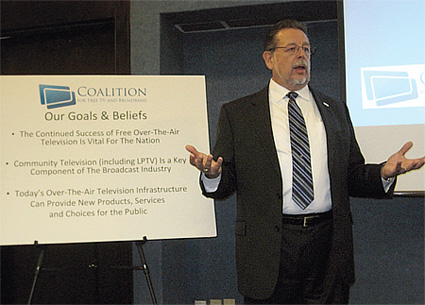

WASHINGTON—The "Coalition for Free TV and Broadband," a group of mostly low-power broadcasters, last month unveiled what it calls an "alternative to the auction of broadcast spectrum." The group contends that its proposal could generate 10-16 times more revenue for the U.S. Treasury than a spectrum auction, and in the long term, make more efficient use of the spectrum. The basic idea is for wireless carriers to be able to "off-load" IP traffic onto the broadcast TV infrastructure, rather than auction off TV spectrum to wireless providers for increasing video-related data traffic.

Mark Aitken, vice president of advanced technology for Sinclair detailed the coalition’s proposal at a National Press Club event. But the group may have trouble being heard. Its primary pitch is unlikely to appeal to Congress or its deficit reduction "Supercommittee." Politicians prefer an instant $26 billion windfall (such as the auction could generate) to show off to voters next year, rather than a potential $400 billion income stream over the course of 30 years, which the Coalition contends is possible.

Wireless carriers—especially Verizon and AT&T—have their eyes on all the bandwidth they can wrench away from broadcasters; just as they have shown little interest in cooperating with broadcasters on Mobile DTV, there's no reason to expect they'll warm to the idea of bandwidth-sharing.

Even the NAB had only a polite response to the plan from the newly formed coalition, which initially consists of Sinclair Broadcasting Group, several low-power TV groups, community and religious broadcasters, small production companies and a handful of technology vendors.

"NAB is studying the Coalition proposal, which offers interesting ideas worth reviewing," NAB Executive Vice President, Communications Dennis Wharton told TV Technology. He emphasized that NAB's "official position continues to be" that it has "no quarrel with incentive auctions so long as broadcasters who choose to stay in business are held harmless. That means no material loss of viewers through repacking, compensation for forced relocation to another channel position."

'AGGRESSIVE ASSAULT'

Despite such reserved response to their proposal, Coalition leaders vow an aggressive assault, focusing on how their plan would enable local broadcasters to allot part of their spectrum for point-to-multipoint broadband service for video, voice and data delivery.

Broadcasters and wireless companies "can work to provide complementary, shared services and infrastructure" to use the UHF spectrum more efficiently, said Mark Aitken, vice president of advanced technology for Sinclair, at the Coalition's Washington debut in mid-October. Sinclair has been actively lobbying against TV spectrum incentive auctions.

Coalition Chief Irwin Podhajser, a Miami-based broadcast consultant who works primarily with LPTV stations, listed benefits of the plan: "better value" because of lower consumer costs, "improved service quality" for fixed, nomadic and mobile services" and —for broadcasters—"avoidance of another 'transition' cost" since the collaborative plan would be "self-funded by broadcasters."

He said that the Coalition has had initial talks with wireless carriers, but he declined to identify them or suggest a timetable for any agreements. The Coalition initially has about 400 members, including about 100 companies, mostly low-power and community TV stations.

At the introductory session held at the National Press Club, Rajiv Hazaray, managing principal at Business Analytix, a Bordentown, N.J.-based media and telecommunications economic evaluation firm, cited new research to emphasize that point-to-multipoint distribution, a broadcaster strength, "is where broadband overlay adds value." He described new research that has identified usage trends for smartphones and tablets, emphasizing that they are being largely used as media consumption devices.

Hazaray said that such content will represent an increasing proportion of mobile traffic.

"If broadcasters are permitted to enhance their technology to seamlessly integrate with mobile devices, vast amounts of mobile data demand can be offloaded from the wireless networks," Hazaray said in his report. "The spectrum efficiency gains of broadcast for video delivery, as compared to individual streams on wireless networks, are vast."

At a more fundamental level, the Coalition is focusing on the threat that the proposed spectrum auction will "shutter" over-the-air TV, especially LPTV and translators, [which] are essential to America," as Podhajser put it.

"Destroying these stations is wrong," he said. "It's un-American. It doesn't make any sense to destroy this market." Podhajser contended that in a worst-case scenario, the shared-overlay broadband/broadcast operation would generate $62 billion during its first 15 years, and another $216 billion would flow to federal coffers in years 16 through 30. He added that a more aggressive agenda could generate up to $400 billion in revenues through the decades.

Another speaker at the Coalition's debut was Randy Weiss, founder/president of "Today with God," a Cedar Hill, Texas, religious programmer. He contended that "more than 2,000 and maybe up to 4,000 TV stations" would go dark as a result of the auctions.

"The wireless phone companies can convince Republicans to shut down broadcasting," Weiss said, a reminder of the political tension involved in the auctions. "Congress should not be allowed to raid the industry" by taking away broadcast spectrum and he suggested that "Congress was unaware that [the auction] had no protection for LPTV or community TV stations."

NEEDED CHANGES

Although the primary Coalition objective involves a broadband/broadcast overlay, additional tinkering is inevitable. Aitken cited "the need to change a standard" in digital broadcast delivery, noting that broadcasters should be working with wireless carriers on the Long Term Evolution (LTE) wireless broadband service to "harmonize" it with standards extensions.

The Coalition's assault comes as the Washington debate over spectrum allocation heats up, spurred by the Supercommittee's search for revenue sources and by the FCC's push for a spectrum auction. On the day before the Free TV Coalition unveiled its plans, the National Telecommunications and Information Administration, said that 1,500 MHz of government-controlled spectrum would be evaluated for commercial wireless service.

The Coalition's plan triggered predictable criticism from wireless lobbyists and analysts. CTIA: The Wireless Association, in a statement, chastised low-power TV stations for sitting on spectrum licenses "for more than 20 years."

"This strikes me as nothing more than a self-serving arbitrage play, said Jot Carpenter, CTIA VP-government affairs.

Jim Snider, president of iSolon.com and a long-time backer of the spectrum auction, complained that "…media conglomerates, with their sycophantic allies in Congress," won't be satisfied until they "have succeeded in upgrading their licenses from broadcast to broadband for chump change to the American public who own the airwaves."

With such acerbic opposition, the Coalition's plan faces a harsh winter in Washington.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.