Streaming Services to Spend $8.5B on Sports Rights in 2023

New major NFL deals with Amazon and YouTube mean streamers will account for one fifth of all sports rights spend this year, according to Ampere Analysis

LONDON—Subscription OTT services’ spending on sports rights globally will reach record levels in 2023, hitting $8.5 billion, a 64% spike from 2022 according to a new report from Ampere Analysis’ Sports analyzing the role of sports in the streaming wars.

The research also predicts that the share of spend on sports rights by streaming platforms will increase in 2023 to reach 21% of global sports rights investment, up from 13% in 2022.

This marks a major change in how streaming services spend their programming budgets. The researchers noted that subscription OTT services’ spend on sports rights has lagged behind their investments in original TV and film. In 2022, 28% of original content spending was from streaming platforms such as Netflix, Disney+, Prime Video and Apple TV+.

However, as streaming technology has improved, and as fans increasingly expect to be able to stream their favorite sports, the sports streaming model finally took off. At the same time, the challenging economic outlook for traditional sports broadcasters – such as pay TV channels, ad-funded commercial channels and public service broadcasters – incentivizes rights owners to appeal to streaming platforms in order to achieve media rights growth.

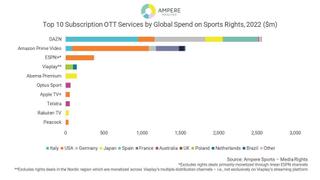

Leading the way for streaming platforms’ growing investment in sports rights, particularly in Europe, is DAZN. The global OTT sports streaming service accounted for more than half (54%) of all subscription OTT services’ spend on sports rights in 2022, Ampere reported.

However, recent years have seen an acceleration in sports rights spend by general entertainment services – such as Peacock and Viaplay – as service providers look to differentiate from peers in an increasingly crowded market. General entertainment services accounted for six of the top 10 subscription OTT services by global spend on sports rights in 2022, the report found.

The exclusive NFL deal with Amazon that kicked off in September 2022 was arguably the turning point for sports on general entertainment OTT platforms. It represented the largest single deal signed to-date by any sports streaming service, and has since been surpassed only by YouTube – also with the NFL.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“The transition to streaming will take longer for sports than for other genres," explained Jack Genovese, research manager at Ampere Analysis. "This is in part because of the nature of sports rights deals, which typically span multiple years. It is also due to the sheer value of sports rights, and the sensitivities characterizing the distribution and consumption of sport. The need for high quality, low latency feeds will continue to favor risk-averse behavior among broadcasters and rights owners alike. However, streaming will offer opportunities for sports to experiment with content, distribution and monetization, which will revolutionize the way in which sports rights are sold and bought in the future."

Ampere’s research uses the media analyst’s latest suite of data products: Sports – Media Rights, which tracks data on sports TV rights in the largest markets around the world, and Sports – Consumer, a regular series of consumer interviews covering sports fans in 12 countries around the world.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.