Fixed Wireless Home Internet Gaining on Traditional Cable Broadband

LRG reports wireless/5G internet services from T-Mobile and Verizon are becoming more competitive with traditional broadband providers

DURHAM, NH—Consumers who want to literally cut the final cord from their cable providers are accelerating their adoption of fixed wireless home internet services from telco competitors like T-Mobile and Verizon, according to a new report from Leichtman Research Group.

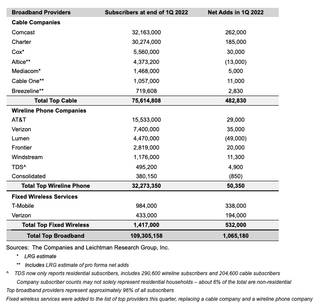

Although the latest report shows that the largest cable and wireline phone providers and fixed wireless services in the U.S.—representing about 96% of the market—logged a healthy gain of 1,065,000 net additional broadband Internet subscribers in 1Q 2022—a pro forma gain of about 1,120,000 subscribers in 1Q 2021—that number included an increase of 530,000 subscribers of fixed wireless/5G home Internet services from T-Mobile and Verizon, a nearly five-fold increase compared to 110,000 net adds in 1Q 2021.

The top broadband providers account for about 109.3 million subscribers, with top cable companies having about 75.6 million broadband subscribers, top wireline phone companies having about 32.3 million subscribers, and top fixed wireless services having about 1.4 million subscribers.

Findings for the quarter include:

- Overall, broadband additions in 1Q 2022 were 95% of those in 1Q 2021

- The top cable companies added about 480,000 subscribers in 1Q 2022, 52% of the net additions for the top cable companies in 1Q 2021

- The top wireline phone companies added about 50,000 total broadband subscribers in 1Q 2022, compared to about 80,000 net adds in 1Q 2021—Wireline Telcos had about 480,000 net adds via fiber in 1Q 2022, and about 430,000 non-fiber net losses

Despite the increase in "cord-cutting," the very definition of the term is relative since most consumers are just dropping their TV subscriptions, but keeping their broadband services with the same pay-TV provider. The increasing adoption of using wireless 5G services to replace traditional wired broadband internet, however, is rapidly changing the face of how consumers access the internet, according to the research firm.

“Top broadband providers added over one million subscribers in 1Q 2022, similar to last year’s first quarter, but the distribution of net broadband additions differed from a year ago,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Fixed wireless services accounted for half of the net broadband adds in 1Q 2022, compared to about 10% of the net adds in 1Q 2021.”

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.