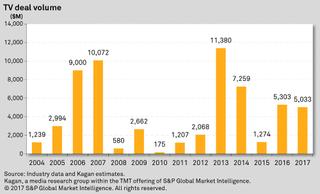

2017 U.S. Broadcast Deals Crack $8B, Highest Since 2014

Click on the Image to Enlarge

MONTEREY, CALIF.—Broadcast stations were active with merger and acquisitions throughout 2017, with S&P Global Market Intelligence’s Kagan research group reporting a total of $8.24 billion in mergers and acquisitions for radio and TV stations. According to Kagan, this is the highest annual deal volume since 2014 and the third highest since 2008.

Of the $8.24 billion in total deal volume, radio was responsible for $3.21 billion while TV made up $5.03 billion. The top mergers of the year were between Entercom and CBS Radio in February for $2.56 billion and the Sinclair Broadcast Group’s merger with Tribune Media Company for $3.76 billion. Even without these deals, Kagan reports 2017 would have shown growth in both radio and TV deals; 23 percent for radio and 79 percent for TV, excluding Nexstar's merger with Media General Inc.

Kagan’s most recent report also offers insight into the fourth quarter numbers for mergers and acquisitions. In TV, deals reached $500.5 million, with the top deal coming in the form of Tegna’s acquisition of Midwest Television Inc.’s stations in San Diego for $303 million; the deal also included additional fundings for Midwest’s radio stations in the market. Other notable fourth quarter deals included NBCUniversal’s Telemundo Station Group acquiring all stations of ZSG Communications Inc. for $75 million and HC2 Holdings acquiring the Azteca American network from affiliates of TV Azteca SAB de CV for an estimated $33 million.

Radio saw its quarter total reach $248.3 million in deals. The top deal for radio was Merlin Media LLC selling its last two Chicago stations, WKQX-FM and WLUP-FM, to Cumulus Media on a $50 million purchase option. The previously mentioned deal between Tegna and Midwest accounted for $22 million for KFMB-AM/FM. A large part of the quarter’s radio deals also came from station swaps, as Entercom had to divest a number of stations to comply with FCC ownership rules following its merger with CBS Radio. Entercom traded 11 of its stations for seven iHeartRadio stations, one station from Beasley Broadcast Group and $12 million in cash. Kagan estimated the swaps’ total value at $148 million.

Visit www.spglobal.com/marketintelligence for more information.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.