Locating Shows Becomes a Cross-Platform Challenge

Gary Arlen Seek and ye shall find… if you’re lucky.

As viewers increasingly shift between broadcast/cable channels and online shows— even during the same screen session—there’s increased value for comprehensive guides that can steer them to what they want to see, wherever it is.

Yet the mantra of “anytime, anyplace, any device” is still just that: a handy slogan, but a frustration for platform-transcending viewers.

The desire to be able to find (not just “search” for) programs becomes even greater in the on-demand realm, whether viewed via cable or online sources. Now add in the multiplatform access provided via smart TVs and new services such as Sony’s PlayStation Vue—which can deliver content from any source almost seamlessly— and the necessity for universal video search becomes essential for many viewers.

It’s an opportunity that cries out for advanced program discovery and navigation. And also for better integrated digital program guides that encompass the full array of available shows, far beyond the classic listings grids and their up/down/left/right onscreen corollaries.

“The discovery process plays a big role in the success of TV content, both online and linear,” says Jon Giegengack, co-founder of Hub Entertainment Research, a Bostonarea media analysis firm. In Hub’s annual “Conquering Content” study, released last month, the firm found that 61 percent of viewers say “they need a universal listing to find shows across all TV sources.”

“The idea of a universal source for searching across platforms has consistently been viewers’ Number One interest” for several years, Giegengack told TV Technology.

Equally striking, the Hub study found that 51 percent of viewers say they have watched a show on linear TV after they first found and watched it online. That kind of crossover viewing underscores the value of integrated program search and navigation. In Hub’s research, 48 percent of respondents said they are more likely to choose sources that make discovery of new shows easy.

Source: “Conquering Content” Hub Entertainment Research, December, 2014VALUE OF INTEGRATED VIDEO DISCOVERY

Further emphasizing the need for cross-platform program search is another new study being issued in two parts this month by NATPE and the Consumer Electronics Association. At the International CES in early January, NATPE President/CEO Rod Perth noted that viewers in 70 percent of broadband homes have streamed fulllength TV programs in the past six months.

That leads to important “implications for how to reach audiences with information about new programs,” Perth said. The full study is being unveiled at the NATPE convention this week in Miami.

Among the preliminary findings revealed at CES were such obvious results as the proclivity of the millennial demographic group (ages 13 to 34) to use “many different sources of TV program content and consequently [they] are significantly more likely to consume full-length TV programs from a streaming source.” The study also confirms that millennials—the most avid consumers of online content—are also the least likely to watch a conventional TV set.

“Only 55 percent of millennials select a television set as the preferred screen for viewing television content,” according to an advance copy of the NAPTE/CEA report.

Such findings, affirming the Hub and other research, are further reminders of the value of cross-platform video content searches. Dozens of program discovery services have sprung up in recent years, but none has attained the iconic role that TV Guide—or even the old newspaper TV pages—provided. Services such as Jinni, which last month signed a deal with Vudu (adding to its alliances with Time Warner Cable, Canal+ and other linear systems), provide extensive cross-platform program information. Google offers a variety of video content search services, which may come in handy as Google Fiber rolls out. TiVo, thanks to its acquisition of guide service Digitalsmiths, has been expanding its cross-platform capabilities. The pioneering blinkx. com, established a decade ago, now focuses almost entirely on Internet video content, monetizing access through advertising.

Yet the infrastructure for a true, full-umbrella video discovery system is haphazard, usually deliberately. Cable operators and online programmers such as Netflix, Amazon and Hulu really don’t want customers to find out everything they could see because, inevitably, a lot of programs would be “outside” their monetized corral.

Moreover, discovering content is not enough. An ideal search/find system should be integrated with a navigation service. Several companies are focusing on the importance of “catch-up” features, which enable a viewer to go back to the start of a show (via VOD technology) even if they “discover” the real-time telecast minutes, hours or even several days after it ran.

OFFERING BETTER TOOLS

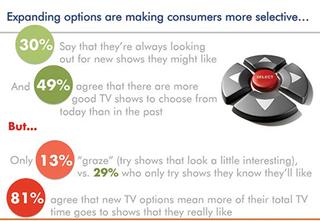

“Conquering Content,” Hub’s latest study on how consumers find and choose new TV shows, also found that while TV consumers appreciate the greater content choice offered by online viewing options, they also have a strong need for tools to make all of that content easier to use. For example:

• 81 percent say that, thanks to new TV options, more of their viewing time is spent on TV shows they “really like” than was the case in the past.

• Only 13 percent “graze,” that is, sample new shows that look even a little interesting, versus 29 percent who say they only try a new show if they’re sure they’ll like it.

“Consumers are now realizing both the benefits and the challenges that come with massive amounts of content available instantly,” Giegengack says. “The almost unlimited catalogs mean that viewers need, and increasingly expect, tools to make discovering shows they’ll love a manageable task.”

Ben Weinberger, co-founder and CEO of Digitalsmiths, says that his company’s tool, distributed via its parent TiVo, allows cable operators to promote all formats of content “to the right audience.”

“They can find anything they want on a single platform,” he said. “The operators can apply business rules based on the goals they want.”

Meanwhile, cable operators— weighing the financial impact of broadband content versus their own linear and on-demand video offerings—are still evaluating the trade-offs of offering a full cross-platform program search/discovery component. For example, Comcast is rolling out its cloud-based X1 platform, which “makes it easier for our customers to access all the programming available to them as part of their subscription through integration of live, On Demand and saved programming and also through intuitive search and discovery,” said Matt Strauss, senior vice president and general manager of Video Services at Comcast Cable.

“We are exploring the ways in which we might expand our collection of apps on X1 over time and continue to work with third parties on the integration of new content and experiences into the platform in a way that’s seamless, intuitive and complimentary to the comprehensive X1 experience,” Strauss said.

But as for creating a revenue stream for OTT content, Strauss simply said, “It’s too early to discuss how we’d monetize Webbased programming on X1.”

So for now, the business reality may trump the marketplace situation in which viewers (at least according to the recent spate of studies) are clamoring for truly integrated video discovery and navigation.

Let’s see where that leads.

Gary Arlen is president of Arlen Communications LLC, a research and consulting firm. He can be reached at www.Arlen-Com.com.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.