Akamai Reports on the State of the Internet

CAMBRIDGE, MASS.—As broadcasters advance farther into the connected digital environment, they become more dependent on fast, reliable Internet and mobile connections.

Ironically, these are links in the chain over which they have little control.

Nevertheless, having a good understanding of the key characteristics of your local, state and U.S. Internet and mobile connections can be valuable for budgeting and strategic planning considerations.

Akamai’s quarterly State of the Internet Report provides insight into global and U.S. statistics, such as connection speeds and broadband adoption across fixed and mobile networks, overall attack traffic, global 4K readiness, IPv4 exhaustion and IPv6 implementation, as well as traffic patterns across leading Web properties and digital media providers. The report also includes information on changes in the mobile landscape.

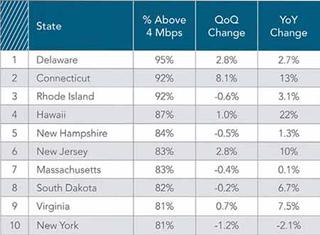

In order to document overall quality of Internet service, Akamai has defined five categories: average and peak connection speeds, broadband and high broadband connectivity and 4K readiness. Currently, Delaware is the leading state in all five of these criteria, while Arkansas placed last in each, with the exception of broadband adoption.

4K READINESS

Global 4K readiness is a new metric, added to track the streaming delivery of Ultra HD video. Since adaptive 4K streams require 10–20 Mbps of bandwidth, this is an indicator of areas with a larger concentration of subscribers who are able to have an enjoyable experience of 4K- “capable” connectivity, resulting in a larger complement of subscribers being able to enjoy a quality experience when receiving 4K streamed content. In this category (Fig. 1), Delaware again leads with 35 percent connectivity above 15 Mbps, while Oregon is 10th with 23 percent.

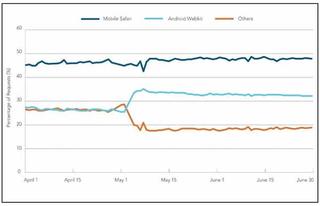

Fig. 3: Leading mobile browsers seen across all networks, Q2 2014

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Streaming audio to a listener’s PC via fixed connections is considered a mature market segment. The new frontier is streaming audio services such as DashRadio or Spotify, which are targeted at mobile devices, and they have become the primary vehicle for consuming music. A recent report from Strategy Analytics notes that audio represents more than 10 percent of bandwidth on many mobile networks. More than three-quarters of mobile users listen to music on their phones, while 70 percent do so once per week or more.

Akamai’s data set was gathered from usage of smartphones, tablets, computers and other devices that connect to the Internet through mobile network providers. Additional insights into mobile voice and data traffic trends were contributed by Ericsson, a global provider of telecommunications equipment and related services. According to their information, within North America, Canada had the highest mobile connection speed at 7.0 Mbps, while the U.S. followed with 6.5 Mbps.

In order to gain insight into broadband adoption levels for mobile connectivity—that is, the percentage of connections to Akamai from mobile network providers at speeds over 4 Mbps— this metric is also tracked. Again, Canada leads North America with 63 percent, while the U.S. has 37 percent available over 4 Mbps.

USEFUL INDICATORS

“For broadcasters planning streaming audio services, the 4K readiness metric might be overkill,” said David Belson, editor of the SOTI report. “A more useful indicator would be broadband (>4 Mbps) adoption.”

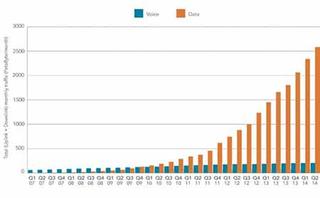

Fig. 4: Total monthly mobile voice and data as measured by Ericsson

He adds that in the United States, 90–95 percent of the fixed connections are at 1 Mbps or higher. Most users experience connection speeds somewhere between the average and peak metrics indicated in SOTI. While there have been modest changes over the last quarter in broadband adoption, both up and down, once again, every state saw more than half of its connections to Akamai occur at speeds over 4 Mbps.

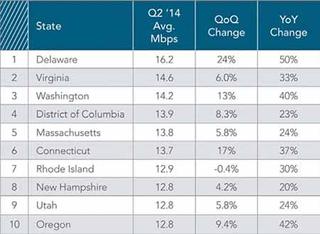

There are a number of reasons for the differences in connection speeds between states (Fig. 2). Population density and geography play a part. It might be easier to bring broadband the final mile in Connecticut, for example, than Idaho.

Google Fiber is a new player that changes the competitive landscape in some states.

Fig. 1: Broadband (>4 Mbps) connectivity, top U.S. states

“Google will announce that they’re bringing fiber to an urban area,” said Belson. “And then the local providers will often launch their own fiber program to customers ahead of Google Fiber’s rollout to get a jump on the market.”

Marketing strategy is also a factor. “Google Fiber and other providers are still very targeted in the areas where they will deliver broadband,” said Belson. “Pricing for delivery to the final mile is also a variable. At $40 per month, it might be attractive, while $400 would price it out of range for most consumers.”

INVESTMENT

State investment in infrastructure, either directly or indirectly, can account for some of the differences, although Belson adds that most states are not making the investment. The majority of capital investment is being made by providers, although this again varies by state. Differences in spending depend on a number of factors, although many decisions hinge on connection sharing and content profiles.

As broadcasters contemplate investment areas for online services, the speed data in SOTI can give some perspective.

“The speed for most wired connections in the United States is not a problem,” said Belson. “What is interesting is the speed for mobile connections, and again, that can vary by location.” He adds that mobile speeds are generally trending upwards nationwide. In those locations where mobile growth has stagnated, however, heavy investments that target smart phone users may not be warranted.

Fig. 2: Average connection speed by state

Another consideration (not published in SOTI) is insights into changing usage of fixed and mobile broadband for entertainment.

“We’re seeing a trend for mobile carriers to zero rate music streaming services,” said Belson. “And if more consumers are listening to music on mobile devices, that may indicate less listenership of satellite and terrestrial radio.”

SOTI also tracks mobile browser usage on cellular networks, as shown in Fig. 3, which focuses on the usage of Android Webkit and Apple Mobile Safari, with other browsers designated as “Others” in the graph. Note that Mobile Safari pulled ahead with 4-5 percent lead. This is significant because it is the first quarter where Safari essentially led Webkit on cellular networks across the full 90-day observation period.

SOTI also reports data gathered by Ericsson, as shown in Fig. 4. It depicts a strong increase in data traffic growth with moderating rate of growth and flat voice traffic development. The number of mobile data subscriptions is increasing rapidly, and driving growth in data traffic along with a continuous increase in the average data volume per subscription. Data traffic grew around 10 percent between the first and second quarters of 2014. This information may be of interest to radio broadcasters, as research from Strategy Analytics suggests that audio accounts for more than ten percent of bandwidth on many mobile networks.

Akamai has recently launched a State of the Internet website, www.stateoftheinternet.com, where past and current editions of this report are available for download, as well as a related Internet security report.

Tom Vernon is a longtime contributor to Radio World. Find more of his articles by searching keyword “Vernon” onradioworld.com.