TV Vendor Stock Snapshot: Sony Sends a Message

Shares of Sony (NYSE: SNE) fell more than a $1 this morning on news that the Japanese electronics giant is expected to post a loss of $1.1 billion for its fiscal year ending in March. It would be the first time in 14 years Sony would post an operating loss. Sony’s American Deposit Receipts on the New York Stock Exchange tumbled from closing at more than $23 last night to open at $22 this morning. Sony ADRs posted a 52-week high of $56.50 and were trading at between $35 and $40 in September when American banks imploded.

Sony’s blues are being blamed on the state of the economy, which drug down sales of its consumer electronics gear, particularly its TV sets. The company’s myriad products--from video games and movies to insurance and banking—aren’t enough to shore it up through the current crunch. Sony announced last month that it would be cutting 16,000 jobs, half of them full time employees representing 4 percent of the work force. The Sony speculation brought Japan’s Nikkei Index down by nearly 5 percent.

In the U.S., the markets are holding at post-September plummet levels. Share prices are about one-half to one-third of what they were before the crash. Diversified companies such as Harris (NYSE: HRS) with its heft military contracts are weathering well, trading to day at near $40 after a high of around $52 Sept. 1.

Wegener Corp. (NASDAQ: WGNR) posted results this week for its first fiscal quarter of ’09, ending last Nov. 28. The Duluth, Ga. satellite content distributor had revenues of $2.3 million compared to $5 million for the same period one year ago. Net loss was $1.2 million, or 9 cents a share, compared to a net loss of $51,000, or a penny a share, the year before.

The company said its 18-month backlog totaled $8.1 million when the quarter closed, compared to $9.9 million the pervious year. The total backlog was $12.5 million, compared to $16.5 million previously. Bookings for 1Q09 were $1.3 million, compared to $3.6 million the previous year.

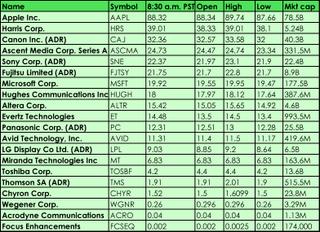

Price snapshot taken at 8:30 a.m. PST, Tuesday, Jan. 13:

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.