DBS and Cable Subscriptions Stabilize

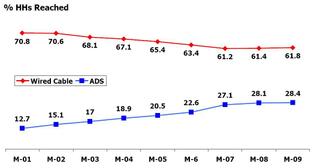

NEW YORK: Satellite TV uptake and cable TV erosion is flattening out, according to Nielsen data. In 2007, cable reached a low, serving just 62.1 percent of total U.S. TV households, while direct-broadcast satellite reached 27.1 percent. Cable made a slight recovery over the last two years, reaching 61.8 percent in May. DBS had a lock on 28.4 percent of U.S. TV households as of May, 2009.

Overall, satellite-delivered TV now represents nearly 32 percent of U.S. TV subscriptions, according to the Television Advertising Bureau, which provided the data. The TVB’s interest in the subscription TV pie has to do with local reach. Unlike big cablers such as Comcast and Time Warner, satellite operators--namely DirecTV and Dish--don’t sell local advertising. Cable operators band together to sell markets through local interconnects, but those arrangements typically don’t cover 100 percent of the TV households in the market.

In Atlanta, for example, the local cable interconnect reaches only 1.3 million of the market’s nearly 2.4 million TV, homes, leaving nearly 1.1 million television households where broadcasters are the sole source of local TV ads (notwithstanding telcoTV providers). The local ad-source gap in Chicago is 1.4 million TV homes. Dallas, one of the largest cities with heavy reliance on over-the-air television--nearly 18 percent of the market--has a gap of nearly 1.7 million homes. Houston is similar, with nearly 20 percent over-the-air reliance and a gap of 1.2 million TV households.

Cable penetration eroded after 2001, when it reached 70.8 percent of U.S. TV households, and direct broadcast satellite was just 12.7 percent. Within two years, cable had dropped to 68.1 percent while DBS captured 17 percent of the subscription TV market. In 2005, cable was down to 65.4 percent and DBS was up to 20.5 percent. Both started stabilizing two years ago.

-- Deborah D. McAdams

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.