Cable and DBS Subscriptions Rise

NEW YORK: Analysts have noted that cable and satellite operators picked up subscribers in the DTV conversion, and overall numbers reflect the trend. Nielsen Media’s count indicates that both cable and satellite subscriptions rose after broadcast analog television signals were cut June 12.

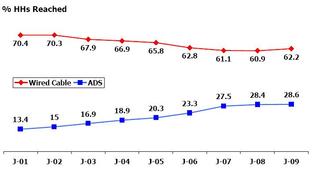

Cable reached 62.2 percent of homes in July, up from 60.9 percent a year ago. Direct broadcast satellite’s reach was 28.6 percent, up from 28.4 percent. The amounts may seem insignificant, but the rise itself is something of an anomaly, since cable subscriptions have been falling steadily for nearly 10 years. DBS has been rising during that period, but had appeared in the last year to stabilize.

Cable reached more than 70 percent of the nation’s TV households 10 years ago, during the industry’s apex. Satellite reached around 13 percent. Cable’s low paint came last July (60.9 percent). This month’s figure represents a high point for DBS penetration.

The Television Bureau of Advertising tracks cable and satellite penetration to cross-reference interconnects, the cooperatives used by cable companies to sell local advertising. The TVB notes that interconnects have less market saturation that the medium itself. Around half of cable subscribers in Washington, D.C, for example, are not reached through an interconnect, and DBS doesn’t yet sell local advertising.

The TVB’s analysis is available on its Web site.

-- Deborah D. McAdams

More from TVB on paid TV subscription trends:

June 30, 2009: “DBS and Cable Subscriptions Stabilize”

Satellite TV uptake and cable TV erosion is flattening out, according to Nielsen data. In 2007, cable reached a low, serving just 62.1 percent of total U.S. TV households, while direct-broadcast satellite reached 27.1 percent. Cable made a slight recovery over the last two years, reaching 61.8 percent in May. DBS had a lock on 28.4 percent of U.S. TV households as of May, 2009.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.